Form W-2 Download

The IRS W-2 form is one of the most important documents when filing taxes. It is an official document that declares the amount of wages and the amount of taxes that were withheld from an employee’s paycheck for the given year. The employer is responsible for providing the employee with a copy of the W-2 form; if it is not provided, the employee will not be able to file taxes correctly.

How to Fill It Out?

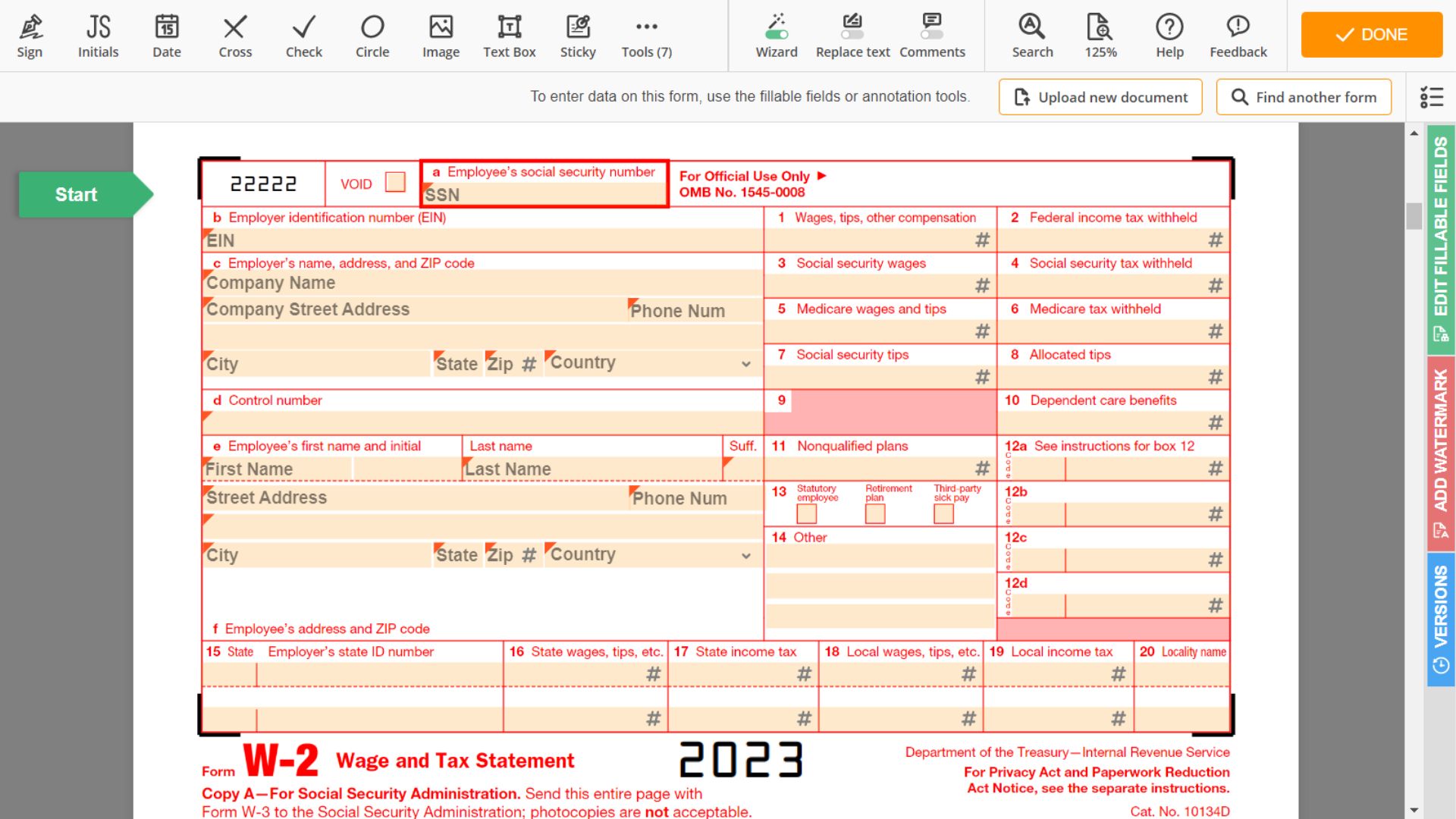

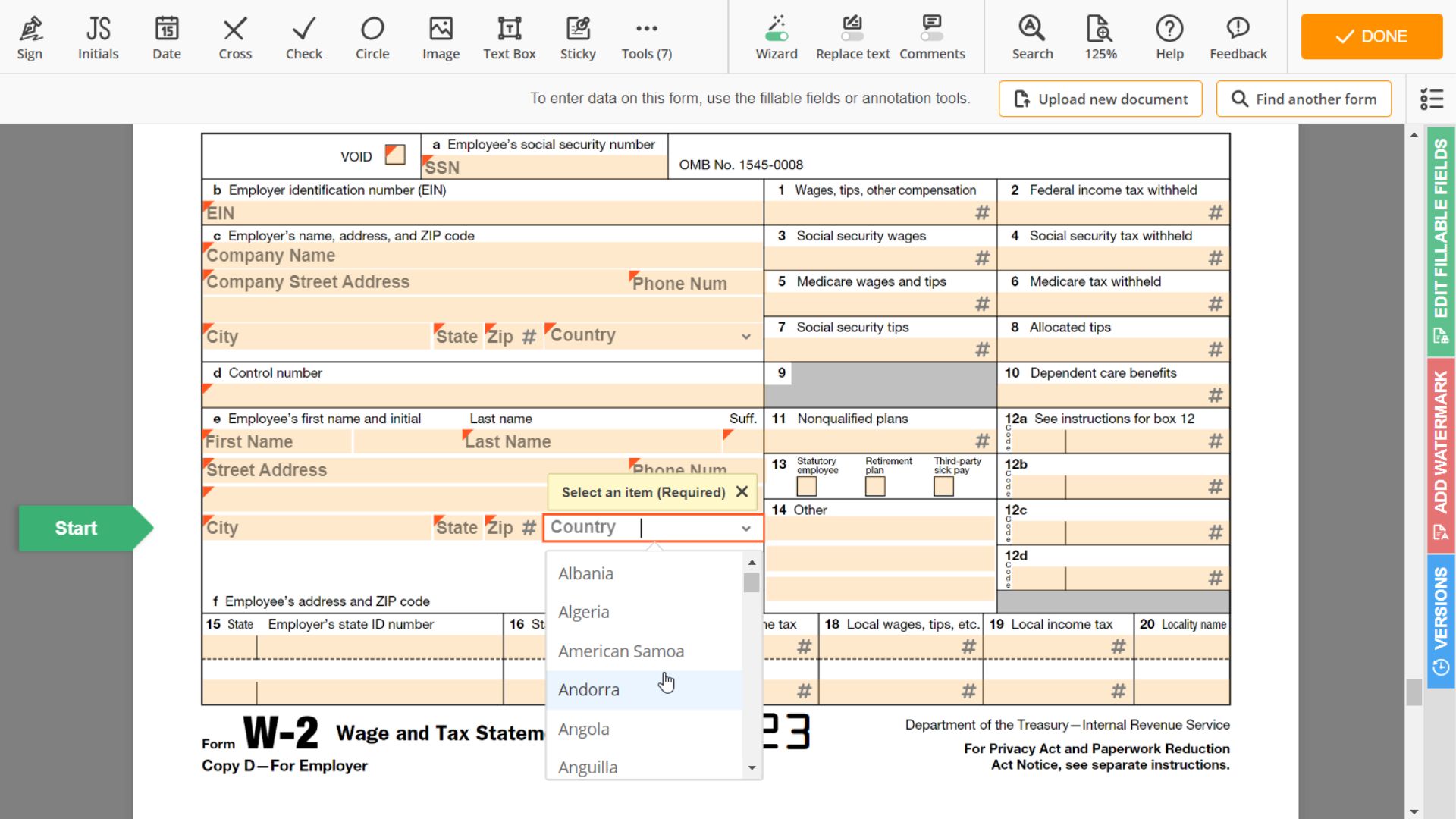

- Completing the W-2 form is fairly straightforward as it only requires the employee to provide basic personal data such as name, address, and Social Security Number.

- The employer information is also needed and should include the name of the company, the employer’s address, and the Employer Identification Number.

- After the employee's personal and employer's data is provided, the employee must fill in the wages and taxes information. This includes the total wages that the employee earned during the year, the total amount of wages that were subject to federal taxes, and the amount of federal taxes that were withheld from the employee’s paycheck.

The Most Common Mistakes

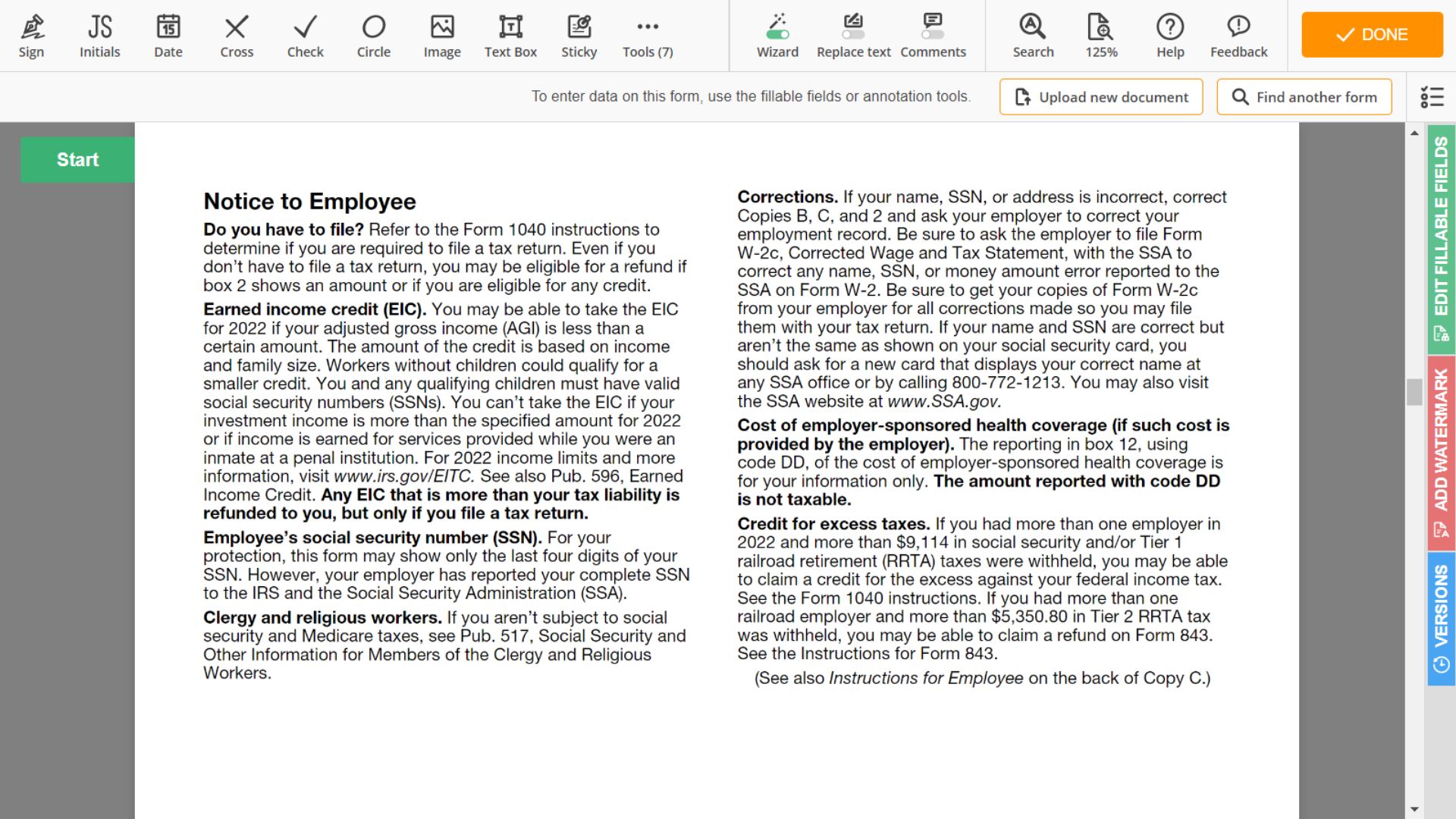

Common mistakes when completing the blank printable template include providing incorrect or incomplete data, not signing the form, and not providing a copy to the employee. It is also important to double-check all the information provided before filing the form.

IRS Penalties

Failing to complete the template correctly or providing fake data can result in penalties including fines and possible jail time. The IRS takes the filing of taxes very seriously and it is important to ensure that the employee’s taxes are filed correctly. Failing to provide the correct information or filing the form late can result in significant fines. It is also important to remember that providing false data is a crime and can result in criminal penalties.

Conclusion

In conclusion, it's a critical document for filing taxes and should be completed with care. The employee should make sure to provide accurate information and double-check all the information before filing the form. Failing to complete the copy correctly or providing false information can result in significant fines or even jail time. Therefore, it is important to take the filing of taxes seriously and ensure that the data provided is accurate.